Basic Formula For Firm Valuation Using DCF Model

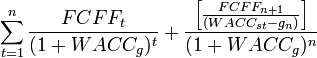

value of firm =

where

- FCFF is the Free Cash Flow to the Firm (i.e. Operating cash flow minus capital expenditures)

- WACC is the Weighted Average Cost of Capital

- t is the time period

- n is the number of time periods

- g is the growth rate

- value of firm is enterprise value

Read more about this topic: Valuation Discounted Cash Flows

Famous quotes containing the words basic, formula, firm and/or model:

“The “universal moments” of child rearing are in fact nothing less than a confrontation with the most basic problems of living in society: a facing through one’s children of all the conflicts inherent in human relationships, a clarification of issues that were unresolved in one’s own growing up. The experience of child rearing not only can strengthen one as an individual but also presents the opportunity to shape human relationships of the future.”

—Elaine Heffner (20th century)

“For the myth is the foundation of life; it is the timeless schema, the pious formula into which life flows when it reproduces its traits out of the unconscious.”

—Thomas Mann (1875–1955)

“Reason sits firm and holds the reins, and she will not let the feelings burst away and hurry her to wild chasms. The passions may rage furiously, like true heathens, as they are; and the desires may imagine all sorts of vain things: but judgement shall still have the last word in every argument, and the casting vote in every decision.”

—Charlotte Brontë (1816–1855)

“If the man who paints only the tree, or flower, or other surface he sees before him were an artist, the king of artists would be the photographer. It is for the artist to do something beyond this: in portrait painting to put on canvas something more than the face the model wears for that one day; to paint the man, in short, as well as his features.”

—James Mcneill Whistler (1834–1903)